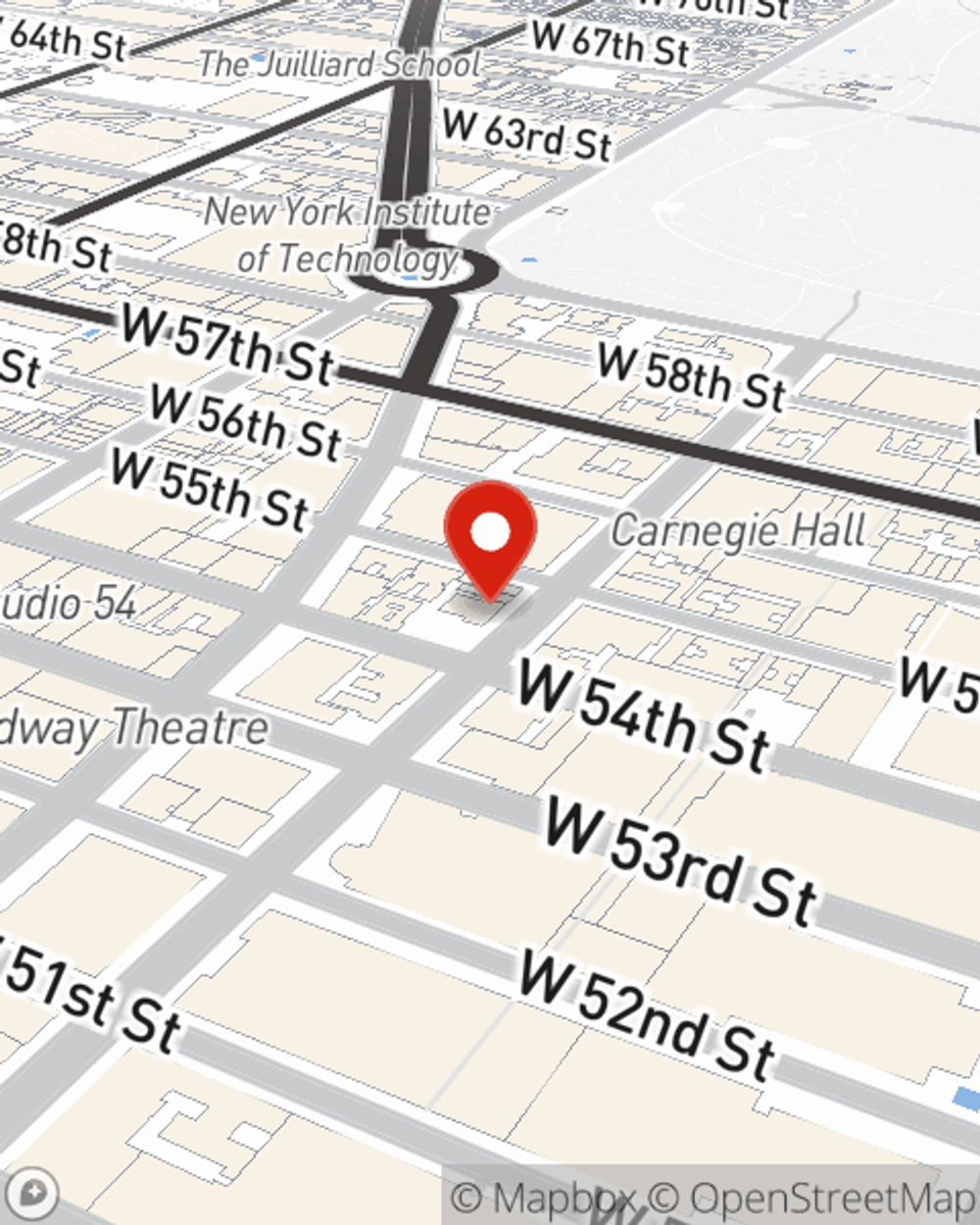

Business Insurance in and around New York

Searching for insurance for your business? Search no further than State Farm agent Robert L Stevenson II!

Helping insure businesses can be the neighborly thing to do

State Farm Understands Small Businesses.

Owning a business is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for the ones you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, errors and omissions liability and extra liability coverage.

Searching for insurance for your business? Search no further than State Farm agent Robert L Stevenson II!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a farm supply store, a toy store, or a beauty salon, having the right coverage for you is important. As a business owner, as well, State Farm agent Robert L Stevenson II understands and is happy to offer customizable insurance options to fit your needs.

Call Robert L Stevenson II today, and let's get down to business.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Robert L Stevenson II

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.